Can You Claim on Car Finance If the Dealer Didn’t Explain the Balloon Payment?

Most people go into a dealership expecting to leave with a car, not a maths puzzle. Yet for many drivers on PCP agreements, that puzzle appears at the end in the shape of the balloon payment, a number that can feel suspiciously like it’s been written with extra zeroes for fun.

If the dealer didn’t explain what the balloon payment was, how it worked, or where it fit into the overall finance cost, it’s understandable to wonder whether the agreement was presented as clearly as it should have been.

Let’s walk through what a balloon payment actually is, what you should have been told, and when unclear explanations might indicate a mis-sold finance agreement.

What is a balloon payment, really?

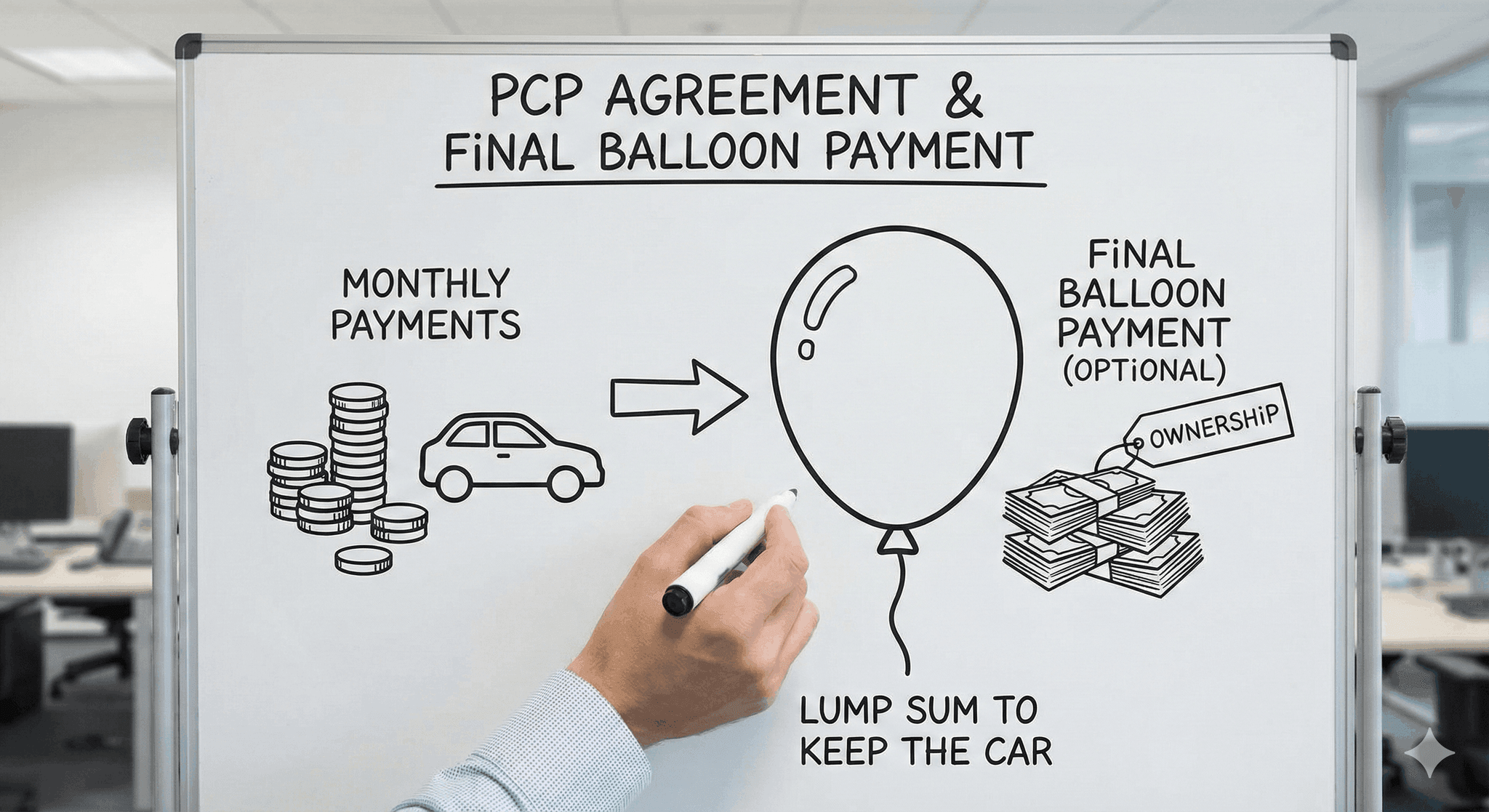

A balloon payment (also known as a Guaranteed Future Value or GFV) is a larger final amount that becomes due at the end of a PCP agreement if you want to keep the car. It’s not a bolt-on fee, a penalty, or a surprise extra, it’s part of the structure of PCP.

Your monthly payments cover only a portion of the car’s value. The remaining amount is deferred to the end, forming the balloon payment. The GFV figure itself is based on the car’s predicted depreciation over the term of the agreement.

In simple terms:

- You pay the car’s expected depreciation in monthly instalments.

- The balloon payment reflects the predicted remaining value at the end.

- You choose whether to pay it, return the car, or explore another deal at that point.

It’s a perfectly normal part of PCP, as long as it’s clearly explained.

What should the dealer have told you?

PCP isn’t complicated once it’s broken down properly, but dealers and lenders have a responsibility to make sure the information they provide is clear, fair and not misleading.

You should have been told:

- The amount of the balloon payment

- How it fits into the cost of the agreement

- When would it become due

- What your end-of-contract options were

- Any fees or conditions relating to those options

If any of this was rushed through, minimised, left out, or hidden in paperwork thicker than a Sunday newspaper, you may not have received the level of clarity required.

Why does the balloon payment cause so much confusion?

It’s usually because many people assume PCP works like a standard loan: you pay monthly, reach the end, and own the car. PCP works differently, and if this difference isn’t explained properly, misunderstandings can easily happen.

Some drivers only realise the final payment exists when they receive a letter about it. That moment is often followed by questions, mild panic, and a very strong cup of tea.

The important point isn’t whether the balloon payment exists (it always does with PCP), but whether you were given the information you needed to understand how it worked before signing.

So… can you claim if the balloon payment wasn’t explained?

Potentially, yes, but it isn’t automatic.

Every situation depends on how the agreement was presented and whether the information provided met FCA requirements. If a dealer didn’t clearly explain key features, including the balloon payment, it could be considered a form of mis-selling.

You may wish to explore the issue further if:

- The balloon payment wasn’t mentioned or wasn’t explained clearly

- You weren’t told how it affected the total cost of the agreement

- You misunderstood the end-of-agreement options due to poor explanation

- The payment was downplayed or described as something you “didn’t need to worry about”

- Fees or conditions linked to the final payment weren’t made clear

This doesn’t guarantee a claim, but it can indicate the agreement wasn’t presented with the transparency required.

What does “making a claim” actually involve?

A claim isn’t instant compensation, and it doesn’t mean anything has gone wrong financially. It’s simply a way of reviewing whether the agreement was sold in line with FCA standards.

It typically involves looking at:

- The discussions you had with the dealer

- whether key costs and features were explained clearly

- whether the documentation matched what you were told

- whether any lack of clarity affected your understanding

If the agreement turns out to have been mis-sold, there may be grounds to challenge it, but outcomes differ from case to case.

If you’re unsure whether things were explained properly, Mis-Sold Expert can help you understand what happened and what your options may be.

What should you do if you think the balloon payment wasn’t explained?

Here’s a simple starting point:

1. Gather your documents - Agreements, emails, and any dealer notes can help establish what you were told.

2. Think back to the conversation - Was the balloon payment explained in a way that made sense? Or mentioned briefly, like a footnote, you were expected to memorise?

3. Request a review - You can have your finance agreement checked to see whether it appears compliant.

4. Take your time - There’s no pressure to act quickly; understanding your position is the first step.

Helpful links if you’re exploring the topic

- PCP Claims Guide

- Car Finance Agreement Checker

- Car Finance Refund Process Explained

- GAP Insurance Mis-Selling Guide

If you believe your balloon payment wasn’t properly explained, or any part of your finance agreement feels unclear, contact Mis-Sold Expert to find out how they can help.

You can claim without using a claims management company; you can go to your finance provider and then to FOS, for free. Additionally, the FCA is introducing a free consumer redress scheme.