FCA Changes to Mis-Sold Car Finance Claim Deadlines: What You Need to Know

If you have taken out car finance in the UK and have concerns about how your agreement was arranged, it is important to be aware of recent updates from the Financial Conduct Authority (FCA). The FCA has amended the timetable for how and when lenders must respond to certain car finance complaints. These changes may affect the timing of complaint responses, but they do not determine complaint outcomes or guarantee compensation.

How Car Finance Really Works in the UK (PCP, HP & Leasing)

Car finance is now the most common way people in the UK pay for a car. Rather than buying outright, many drivers choose to spread the cost through monthly payments using finance agreements such as PCP, Hire Purchase, or leasing.

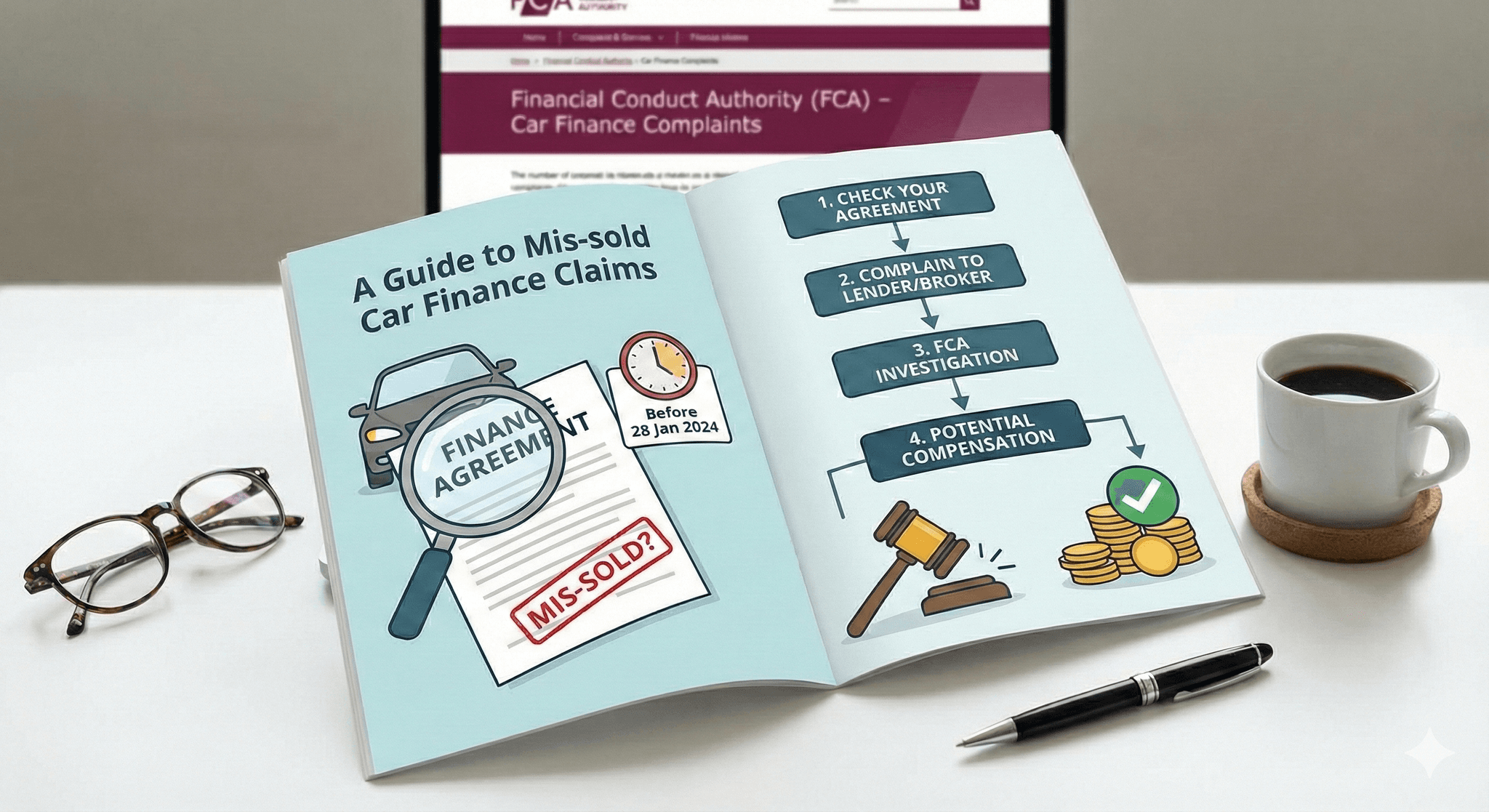

A Comprehensive Guide to Car Finance Claims

Car finance has grown into the dominant method of buying cars in the UK. Over the last decade, millions of drivers entered into Personal Contract Purchase (PCP), Hire Purchase (HP), or other regulated credit agreements. These products were designed to give consumers flexibility, predictable payments, and access to newer vehicles.

A Guide to Mis-Sold PCP Car Finance - What You Need To Know

Unsure about your PCP agreement? Explore signs of mis-selling and how to review your finance contract with trusted, professional support.