A Comprehensive Guide to Car Finance Claims

Why Car Finance Claims Have Become a Major UK Topic

Car finance has grown into the dominant method of buying cars in the UK. Over the last decade, millions of drivers entered into Personal Contract Purchase (PCP), Hire Purchase (HP), or other regulated credit agreements. These products were designed to give consumers flexibility, predictable payments, and access to newer vehicles.

However, the structure of car finance, particularly PCP, can be complicated. Agreements include elements such as balloon payments, mileage allowances, condition requirements, and optional services. This complexity means that consumers sometimes later question whether everything was explained properly at the time of sale.

Car finance claims typically arise when consumers believe their agreement may have been mis-sold, or where the explanation at the point of sale may not have given them a full understanding of costs, conditions, or options. Importantly, raising a claim in this context does not automatically imply wrongdoing, nor does it guarantee any financial outcome. It simply means the customer wants the firm to review whether the agreement was presented clearly and fairly.

This guide explores the landscape of car finance claims across the UK. It explains how common issues arise, what the FCA and the Financial Ombudsman Service (FOS) say publicly about motor finance practices, and what consumers can do if they have concerns about the way their finance was arranged.

How Car Finance Agreements Work

Car finance agreements fall broadly into three categories: PCP (Personal Contract Purchase), HP (Hire Purchase), and PCH (Personal Contract Hire, which is leasing rather than credit). PCP and HP are regulated by the Financial Conduct Authority (FCA) and involve a formal credit agreement between the consumer and a finance provider.

PCP Finance in Brief

PCP separates the vehicle’s cost into three components:

- A deposit

- Monthly payments

- An optional final payment (“balloon payment”)

Consumers can either return the car, pay the final sum to own it, or part-exchange it. Because the final amount is deferred, monthly payments are lower, but this sometimes leads consumers to overlook the total cost.

Hire Purchase (HP) Finance

HP is simpler: the consumer makes fixed monthly payments until the full amount is repaid. There is no balloon payment. Ownership transfers automatically once all instalments and fees have been paid.

Why Consumers File Claims

Most car finance claims stem from misunderstanding, uncertainty, or concerns about disclosure, rather than deliberate wrongdoing. The most common reasons people revisit their agreement include:

- The balloon payment was not clearly explained

- Interest rates or total costs felt unclear

- Commission arrangements were not disclosed

- Mileage and condition rules caused confusion

- Consumers felt rushed or pressured

- Affordability discussions seemed superficial

The FCA and FOS both emphasise that firms must provide clear, fair, and not misleading information. When consumers feel these standards were not met, they may make a complaint, commonly known as a car finance claim.

The Regulatory Landscape: What the FCA and FOS Say

The regulatory guidance around car finance comes mainly from two bodies:

The Financial Conduct Authority (FCA)

The FCA oversees how lenders and dealerships provide regulated credit. Their rules require firms to:

- Treat customers fairly

- Assess affordability

- Provide clear, prominently presented information

- Ensure commission structures do not create conflicts of interest

- Assist vulnerable customers appropriately

In 2021, the FCA banned certain discretionary commission models, which had allowed brokers to adjust interest rates to increase their commission. The ban followed concerns that such practices created incentives to offer higher rates.

The Financial Ombudsman Service (FOS)

The FOS resolves disputes between consumers and firms if the consumer is unhappy with the firm’s response. FOS case studies show that complaints often focus on:

- Whether commission was adequately disclosed

- Whether the consumer understood the optional final payment

- Whether mileage limits were discussed

- Whether affordability checks were sufficient

- Whether the consumer was pressured into finance

The Ombudsman makes decisions on a case-by-case basis, examining evidence, communications, and regulatory standards at the time of the sale.

Where Car Finance Mis-Selling Concerns Typically Arise

It is important to note that none of the following automatically indicates mis-selling; they are simply the most common themes behind consumer complaints.

Undisclosed or Unclear Commission Arrangements

Commission has long been part of the motor finance industry. Sales staff often receive incentives for arranging finance. The FCA notes that while commission itself is not inherently problematic, the lack of transparency may cause concern.

Some consumers have since discovered that:

- Commission existed and was not mentioned

- The salesperson’s commission could increase if a higher interest rate was agreed

- They were not encouraged to compare rates or explore alternatives

This has led many customers to ask whether they were fully informed.

Confusion Around the Optional Final Payment

The balloon payment remains one of the biggest sources of confusion in PCP. Many customers believed:

- They would own the car automatically at the end

- The monthly payment represented the true cost of the agreement

- The balloon payment was optional but did not understand the implications of not paying it

If a consumer did not fully understand how expensive the final payment might be, they may later feel the agreement was not explained clearly enough.

Mileage Limits and Condition Charges

Mileage limits significantly influence PCP pricing. Exceeding the allowance can lead to end-of-term charges. Some customers say they were not told how these charges worked or why mileage mattered so much. Others say they were encouraged to choose a lower allowance to reduce monthly payments without understanding the likely impact later.

Similarly, customers sometimes express surprise at end-of-lease condition charges if they return the vehicle. If these conditions were not discussed, consumers may later raise concerns.

Affordability and the Sales Environment

Affordability is a major regulatory requirement. Lenders must make reasonable checks to ensure the agreement is affordable. However, consumers sometimes feel the assessment was rushed or superficial. Others say the salesperson did not ask further questions when affordability might reasonably have been explored in more depth.

Pressure selling can also influence decisions. Some drivers later say they felt they needed to sign quickly to secure a deal, or that the focus was heavily on the monthly figure rather than the overall commitment.

How to Review Your Own Car Finance Agreement

If someone is unsure whether their car finance agreement was explained clearly, reviewing the paperwork is a helpful first step. Agreements include detailed information about costs, balloon payments, mileage, and commission disclosure (if applicable).

A consumer might reflect on questions such as:

- Did I fully understand the interest rate and total amount repayable?

- Was the balloon payment explained in clear, practical terms?

- Were mileage limitations and possible charges discussed?

- Was I aware of the salesperson’s commission incentives?

- Did the agreement feel rushed or unclear at the time?

These reflections do not determine whether mis-selling occurred, but they help the consumer understand whether communication felt adequate.

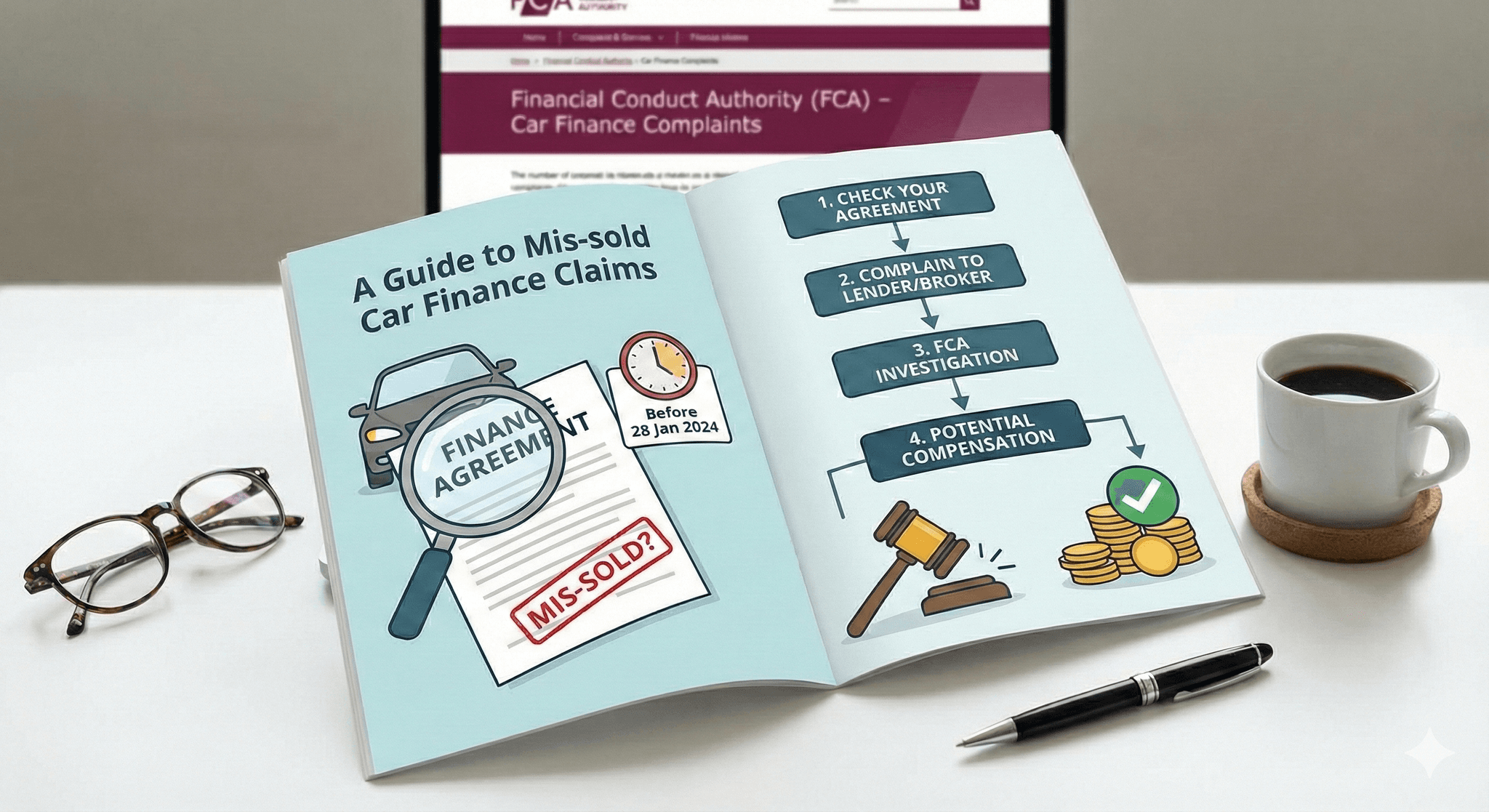

The Car Finance Claims Process Explained

Car finance “claims” in the UK follow a defined structure, underpinned by FCA rules and the Financial Ombudsman Service’s procedures.

Step 1: Gather Your Documentation

Consumers typically begin by collecting:

- The credit agreement

- Pre-contract information

- Any emails or communication with the dealership

- Payment records

- End-of-agreement paperwork

These documents help clarify what was agreed and what was communicated.

Step 2: Raise a Concern with the Finance Provider

The first point of contact is usually the lender, not the dealership. Lenders are responsible for assessing complaints and deciding whether the agreement was presented clearly.

Firms generally have eight weeks to respond. Their investigation may include reviewing call recordings, paperwork, and dealership notes.

Step 3: Escalate to the Financial Ombudsman Service (If Necessary)

If the consumer disagrees with the firm’s final response or receives no response within eight weeks, they can take the complaint to the FOS. The Ombudsman will review:

- What information the customer received

- Whether the terms were fair, clear, and not misleading

- Whether commission was disclosed appropriately

- Whether affordability checks were reasonable

The Ombudsman’s decisions are case-specific and depend on evidence.

Step 4: Potential Outcomes

Outcomes vary significantly. Some complaints are upheld, others are not. Compensation, refunds, or adjustments (where they occur) depend entirely on the findings of the investigation. No result is guaranteed.

Types of Car Finance That Commonly Give Rise to Claims

While PCP generates the most discussion due to its complexity, claims can also arise from HP agreements and add-on products such as GAP insurance.

PCP Claims

Most PCP concerns relate to:

- Balloon payments

- Mileage and condition issues

- Commission

- Whether the overall structure was understood

HP Claims

HP concerns tend to focus on:

- Affordability

- Transparency of total costs

- Whether ownership expectations were clear

How the FCA’s Motor Finance Review Changed the Landscape

In recent years, the FCA has increased scrutiny of how motor finance is sold. The regulator’s review noted variations in how interest rates were set and how commission affected pricing. The 2021 ban on discretionary commission models was intended to improve fairness and transparency.

The FCA continues to monitor the market, emphasising that firms must treat customers fairly and ensure their processes meet regulatory expectations. This scrutiny has encouraged more consumers to re-examine their agreements, leading to increased visibility of car finance claims.

A Responsible Perspective on Car Finance Claims

Most dealerships and lenders aim to follow regulatory standards and provide clear explanations. Car finance is an essential product for many consumers, and the majority of agreements work as intended. Mis-selling concerns typically arise not from deliberate misconduct but from misunderstanding, unclear communication, or the complexity of the product itself.

Raising a concern does not make the consumer “wrong” or the firm “guilty”; it simply ensures that the agreement is reviewed properly. Transparency protects both consumers and firms by ensuring expectations were aligned.

Conclusion: Empowering Consumers Through Clarity

Car finance claims exist because consumers deserve to understand the products they commit to. PCP and HP agreements can work well when explained clearly, but confusion can arise when key elements are not fully discussed.

This guide provides a balanced, FCA-compliant explanation of the process, helping consumers reflect on their agreements and understand their options without promising outcomes or offering legal advice.

If you believe you were mis-sold car finance, contact Mis-Sold Expert to find out how they can help.

You can claim without using a claims management company; you can go to your finance provider and then to FOS, for free. Additionally, the FCA is introducing a free consumer redress scheme.