What to Do If Your Car Finance APR Was Increased Without Proper Explanation

When you enter into a car finance agreement such as PCP or HP, you should be given clear and fair information about how your APR (Annual Percentage Rate) is calculated. APR reflects the overall cost of borrowing, including interest and certain fees, and helps you understand how much the agreement is likely to cost over time.

If the APR on your agreement was higher than you expected, changed without clear communication, or did not match earlier conversations or indicative quotes, you may feel that the information provided at the time was not sufficiently transparent. This article explains how APR works, why some people notice differences, and the steps you can take if you believe an increase was not explained properly.

Understanding Why APR Matters

APR shows the total yearly cost of borrowing and includes the interest rate along with certain charges. This figure affects the total amount repaid over the course of the agreement and can influence whether the finance feels manageable for the borrower.

Because of this, lenders and brokers are required to present information in a way that is fair, clear and not misleading. If your APR changed, or you were not given a clear explanation of how it was determined, this may raise questions about whether you were given enough information to make an informed decision.

Why APR Can Sometimes Change

There are several reasons why the APR you ultimately received may differ from early figures.

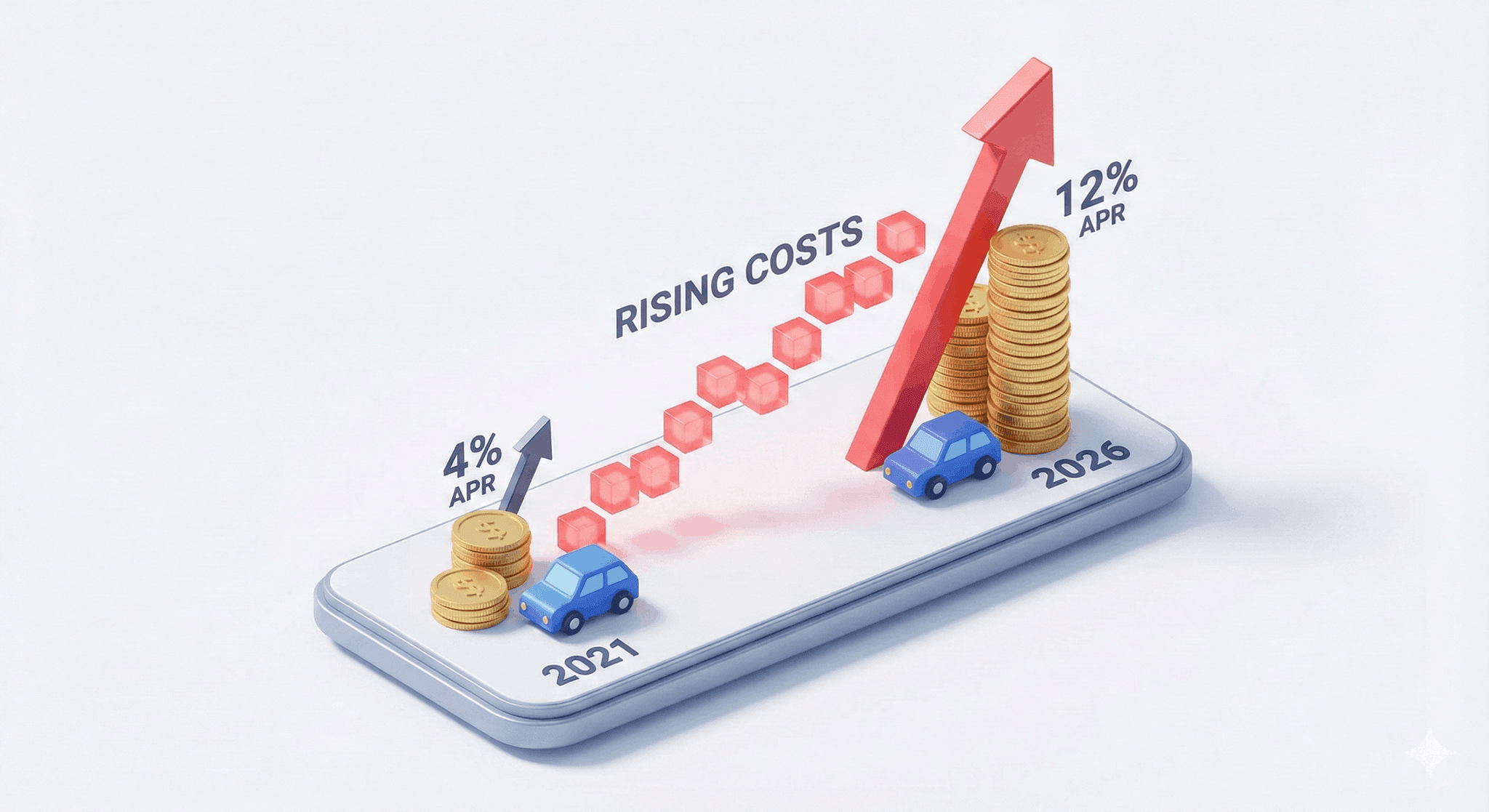

Before 2021, some dealers had discretion to adjust interest rates, which could result in differences between initial discussions and the final agreement. Historic commission models also allowed brokers to earn more when customers accepted a higher APR. These models have since been banned, but older agreements may still reflect their influence.

In other cases, differences arise simply because the initial figure was an indication rather than a confirmed quote. Lenders also assess applications using their own criteria, so details such as credit history, income information or affordability assessments may change the final terms.

Some consumers report that they were given limited time to review documents, or that there was little explanation about why the final APR differed from what they expected. If the information was unclear or incomplete, this may contribute to confusion later.

How to Tell If Your APR Increase Was Not Properly Explained

People often notice potential issues when reviewing their paperwork or comparing it with earlier discussions. You may have expected one rate based on online calculators or initial conversations, but the agreement shows another. You might also have felt that the explanation you received did not fully set out the reasons for the change.

If you were not given written information in advance, felt rushed during the process, or did not understand how certain elements of the agreement affected the final APR, you may feel that the explanation provided was not sufficiently clear.

What You Can Do If You Believe Your APR Was Increased Unfairly

If you are concerned that your APR changed without proper explanation, you can start by gathering any documents you were given during the process. This may include your finance agreement, emails or messages, earlier figures or quotes, and any other information you relied on at the time.

You can then contact your lender to request clarification about how your APR was calculated and why it differs from any earlier figures you were shown. Lenders are expected to respond within eight weeks.

If you feel the explanation does not address your concerns, you can raise a formal complaint with the lender. If the matter still isn’t resolved to your satisfaction, you can take your complaint to the Financial Ombudsman Service (FOS), which can look at whether the lender acted fairly and provided the necessary clarity.

Could This Lead to Compensation?

Some consumers have had historic agreements reviewed where the explanation of the APR was unclear or where important information may not have been provided at the right time. Outcomes vary, and there is no guarantee of a particular result, but in some cases lenders have adjusted agreements or refunded interest after a complaint was raised.

What happens in any individual case depends on the circumstances and the evidence available.

If you believe you were mis-sold car finance, contact Mis-Sold Expert to find out how they can help.

You can claim without using a claims management company; you can go to your finance provider and then to FOS, for free. Additionally, the FCA is introducing a free consumer redress scheme.