Hidden Commission Car Finance Explained: The Reason Thousands Are Claiming Compensation

If you have recently heard people talking about “hidden commission car finance” and felt an immediate need to make a cup of tea before dealing with it, you are in good company. Thousands of drivers across the UK have been reviewing old finance agreements to determine whether everything was explained clearly as it should have been.

This rise in interest is not because people have suddenly developed a newfound enjoyment for reading old financial paperwork. The Financial Conduct Authority (FCA) highlighted concerns about how commission arrangements worked in some past motor finance sales, which encouraged many customers to take a closer look. If your car finance agreement was signed back when satnavs still needed suction cups, it is worth understanding the basics.

Here is a simple and friendly breakdown of what hidden commission means, why so many people are talking about it, and what you can do if you suspect you were affected.

What Is Hidden Commission in Car Finance?

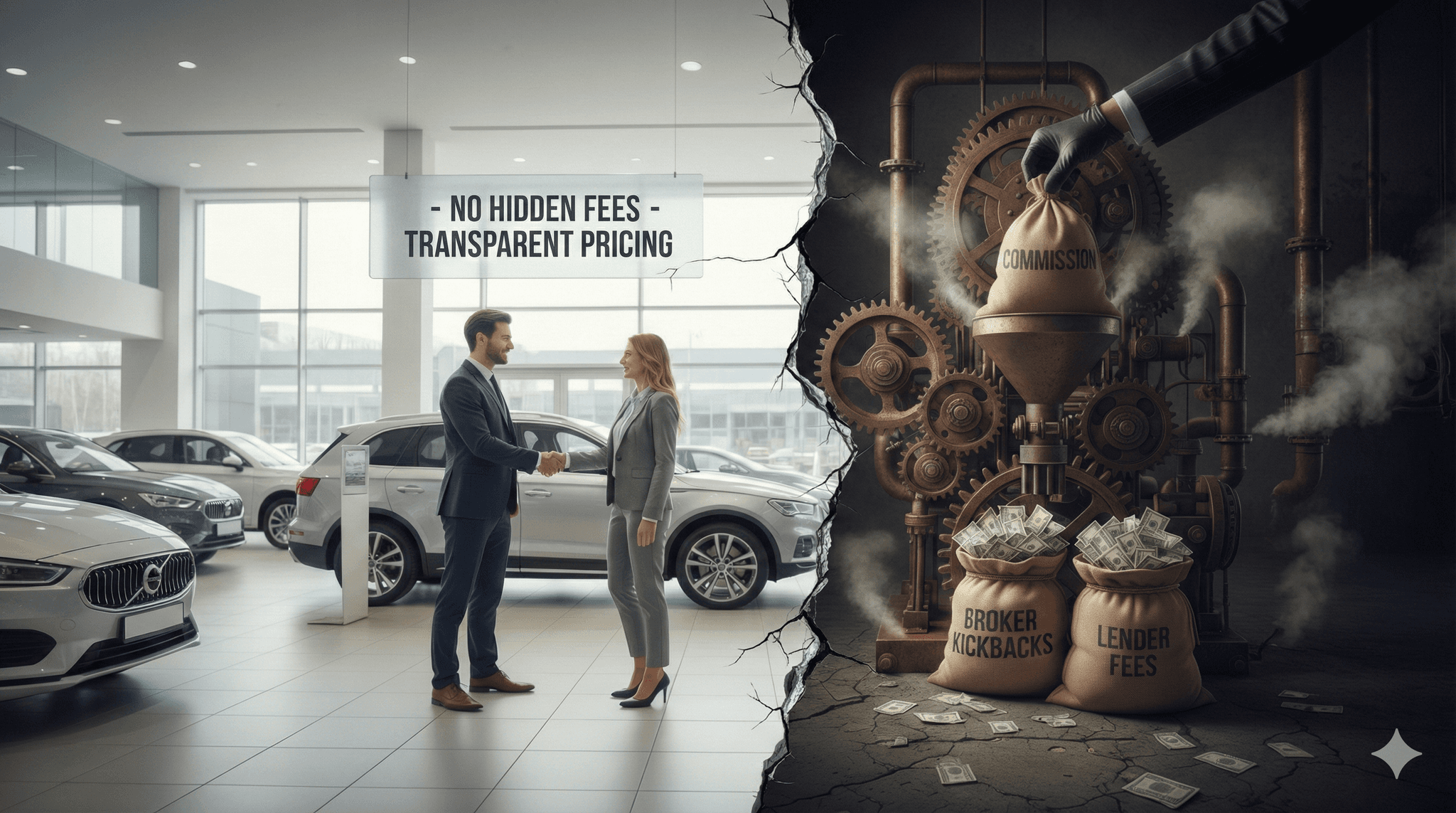

In many older car finance deals, car dealers or brokers received commission payments from finance providers for arranging the finance agreement. This practice is not unusual; commission exists in plenty of industries.

The concern arises when the customer was not told about the commission or the way it was calculated. In some cases, the interest rate could be adjusted by the car dealer or broker. A higher interest rate sometimes led to higher commissions for them.

This arrangement was known as discretionary commission arrangements (DCAs). The name sounds technical, but the idea is fairly straightforward. Imagine a restaurant telling the waiter they can increase your bill if it boosts their tip. You would probably want to know that before ordering dessert.

Why Discretionary Commission Arrangements Became a Significant Issue

For many people, the problem was not that commission payments existed. The issue was that they were not always properly disclosed. Customers were often unaware of several important points:

- Commission was being paid to the car dealership or broker.

- The interest rate on the car finance agreement was not always fixed.

- Higher rates could increase the salesperson’s earnings through commission payments.

When information like this is missing, customers cannot make fully informed decisions. Clear and fair explanations are important for any financial product, especially one that can last several years.

The Role of the Financial Conduct Authority and the Supreme Court Ruling

The Financial Conduct Authority (FCA) has been investigating hidden commission car finance and discretionary commission arrangements. In January 2021, the FCA banned DCAs due to concerns they incentivised brokers to charge higher interest rates unfairly.

In August 2025, the Supreme Court delivered a landmark ruling on claims relating to mis sold car finance agreements involving undisclosed commission payments. The ruling clarified when commission arrangements may have been unfair or unlawful.

Following this, the FCA announced a proposed compensation scheme (also called a redress scheme) to help eligible customers receive compensation payments if they were owed compensation due to these commission arrangements not being properly disclosed.

Why Thousands Are Raising Complaints About Car Finance Commission

After the FCA completed its review of historic practices and the Supreme Court ruling, many people started checking their old finance agreements. A large number of customers felt unsure about whether their agreement was presented properly, which led to a rise in complaints being submitted to car loan providers and finance companies.

It is important to be realistic. Raising a complaint does not guarantee compensation. Every case is reviewed on its own circumstances. The increase in complaints mainly shows how widespread the concern has become across motor finance agreements, including personal contract purchase (PCP) and hire purchase agreements.

How to Know if Hidden Commission May Have Affected Your Car Finance Agreement

You do not need a magnifying glass or a detective hat. A few simple questions can help you identify potential issues:

- Were you told that commission was paid on your car finance agreement?

- Were you told that the interest rate was fixed and could not be changed?

- Did the car dealer or broker offer you different finance options?

- Did anyone explain how your interest rate was chosen or whether the rate could vary?

If most of these topics were never discussed, your agreement may not have been explained clearly enough, and you may have been mis sold car finance.

What You Can Do If You Are Concerned About Hidden Commission

If something does not feel quite right, the first step is to raise a complaint directly with your car loan provider or finance company. Every lender has a formal complaints handling process. They will review what happened and provide a final response letter explaining their findings.

Many people also request copies of their old finance documents. Reading through the original paperwork, ideally with a relaxed mindset and no distractions, can help you understand how the agreement was presented at the time.

If you are unhappy with your lender’s final response, you can escalate your complaint to the Financial Ombudsman Service, a free and independent body that resolves disputes between consumers and finance providers.

Beware of Claims Management Companies

While you may come across claims management companies offering to handle your complaint, it is important to know that you do not need to use one. The FCA and Financial Ombudsman Service recommend dealing directly with your lender or using free services to avoid paying high fees that can reduce any compensation owed.

What Compensation Could You Be Owed?

The proposed FCA compensation scheme aims to provide redress to customers affected by undisclosed commission arrangements. Compensation payments are expected to average around £700 per car finance agreement, but the exact amount varies depending on individual circumstances.

The scheme covers agreements taken out between April 2007 and November 2024 and includes personal contract purchase and hire purchase agreements.

A Trusted Motor Finance Market Moving Forward

The FCA and the Finance and Leasing Association are working to ensure that commission arrangements are now properly disclosed and regulated, helping to restore trust in the motor finance market.

If you suspect you were affected by hidden commission car finance, taking timely action by checking your agreements and raising complaints where necessary will help protect your rights and ensure you receive any compensation owed.

What This Means for Car Finance Customers

Hidden commission in car finance highlights why transparency and fair treatment matter in the motor finance market. Undisclosed commission and discretionary pricing may have affected the interest rates some customers paid, often without their knowledge. Regulatory action, including the FCA’s ban on discretionary commission arrangements and the proposed compensation framework, aims to address these issues and strengthen consumer protection. If you have concerns about a past car finance agreement, reviewing your paperwork and contacting your lender is a sensible first step, with the option to escalate to the Financial Ombudsman Service if needed. Greater openness and fairness remain central to maintaining trust in a market relied upon by millions of UK households.

If you believe you were mis-sold car finance, contact Mis-Sold Expert to find out how they can help.

You can claim without using a claims management company; you can go to your finance provider and then to FOS, for free. Additionally, the FCA is introducing a free consumer redress scheme.